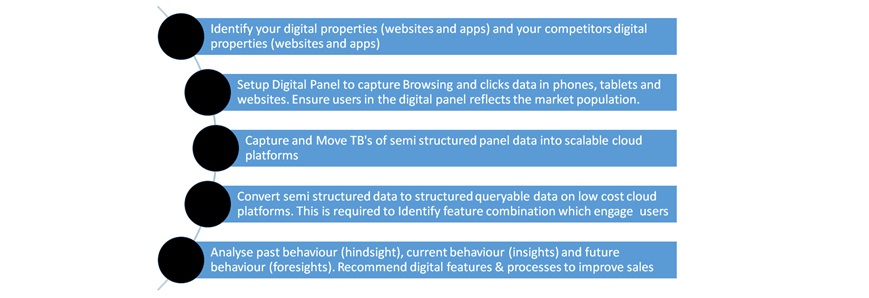

In order to provide accurate digital insights that are representative of the browsing population across devices, companies are increasingly looking to collect consumer behavior data from multiple sources. They then look to blend those sources into a single digital panel, and use algorithms and advanced analytics techniques to normalize the data to the population as a whole.

Digital panels track every click of the panel member, search key words and can help understand path to purchase better (either in their digital property or at competitors property). Once the raw digital behavioral data in the panel is collected, it is sent to analytics firms like LatentView. We break the semi-structured data like search results pages, log files, social messages, and email messages into structured data that is queryable. Once the data is migrated into structured data, the data can be analyzed for past user behavior (hindsight), current user behavior (insight) and future user behavior (foresight). This will help in building new digital processes, improving existing processes and increasing traffic to sales conversion ratio.

CASE STUDY: Competitor analysis on clickstream data:

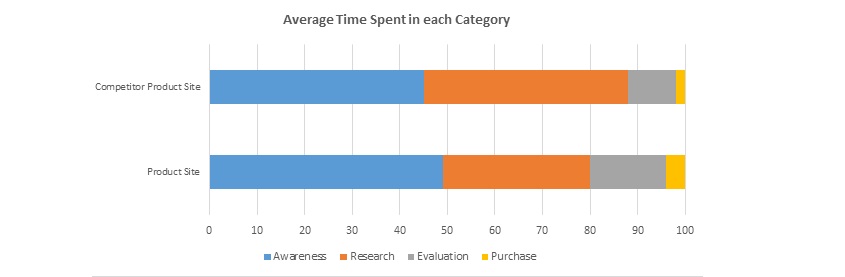

A leading search engine provider wanted us to help them find out what path was taken by users before going to their purchase website (how much time they spent researching the product, reading reviews about the product, time spent in each category vis-à-vis, the time spent on a competitors website).

LatentView built an innovative, automated and standardized framework to analyze clickstream logs and mine insights around user positioning in the purchase funnel. This framework programmatically sorted clickstream pages into different categories using an ensemble of predictive modeling methods on high-end EC2 machines.

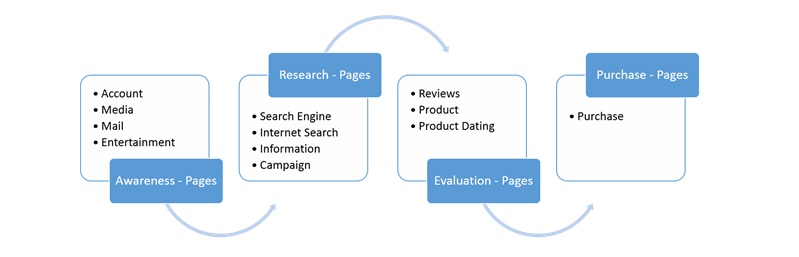

Post categorization of the pages, we conducted an analysis to study the position of the user in the purchase funnel (customer decision journey) for each session. This was identified based on browsing activity, activity duration, age of the member and time of day. We then identified key signals that would aid the ad and result in customization. These insights were used by their planning team in their efforts to make relevant changes to their website. All paths from clickstream can be broadly categorized into awareness, research, evaluation and purchase website (company’s site or competitor’s site).

Here were some of the insights we helped our client with:

• The clothing and shoes category had a very high probability of users purchasing online and the purchase behavior was strongly supported by price and product comparison in search engines.

• Search engines followed by intra-site searches fuel users towards purchase.

• Emails can be an effective medium for promoting clothes and shoes.

• Also, most users who visited their competitor’s purchase link end up going back to their search engine or another shopping page; click-thru to actual merchant is low.

• Search engines followed by intra-site searches fuel users towards purchase.

• Emails can be an effective medium for promoting clothes and shoes.

• Also, most users who visited their competitor’s purchase link end up going back to their search engine or another shopping page; click-thru to actual merchant is low.

Combining the above analysis with user behavior and based on the path used, we were able be able to predict the probability for purchase at the end of session.

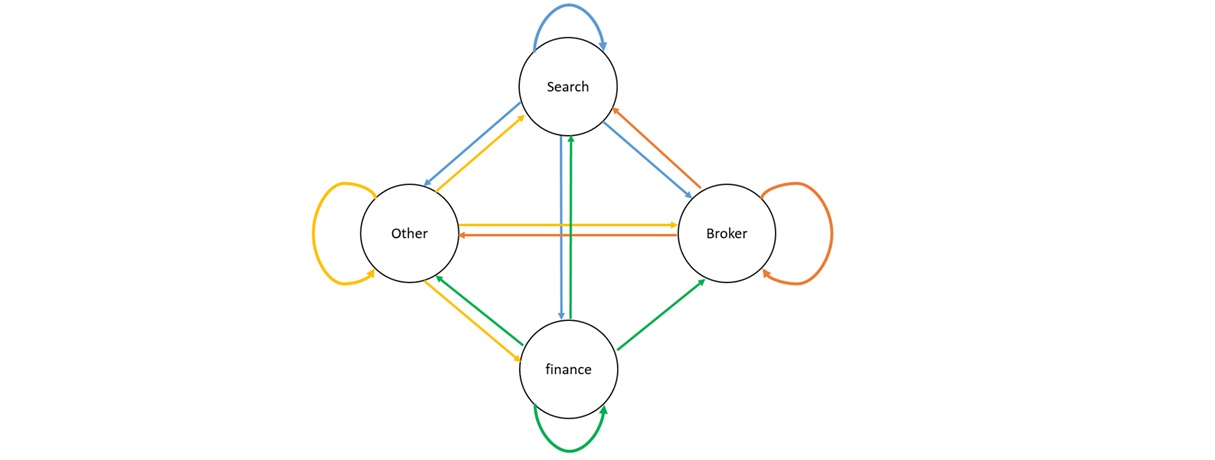

We also performed a Financial Services Monetization analysis for the same company. The objective of the analysis was to understand what users do after searching for a stock query and how they can monetize the same. On analyzing the clickstream data, we found that the two most common actions after a stock query was to visit stock financial advisory sites and the brokerage sites. The current answer block already addresses the research intent. So to address the purchase intent, which is evident through visits to brokerage sites, we recommended showing brokerage ads and adding a buy/sell button as two options. The client’s engineering wing decided to flight both these features in the following weeks based on our recommendation.

As we move into the cross-platform and digital world, delivery of accurate, stable and accredited data takes on increasing importance. To get there, we will continue to need a valid, representative, consistent and comprehensive view of audiences, which is why high quality panels continue to be of primary importance.

In case you have a digital property and would like to know the comparison of user experience between your competitors website tor mobile app and your website or app, please contact us at: sales@latentview.com

With inputs form Vyshnavi Eluri.

No comments:

Post a Comment