Very rarely do you see CEOs that also have a CIO background. How did you look at the same data world when you were a CIO, and how are you looking at it now?

Well it’s interesting. The reason I came to Philips is because Frans van Houten, CEO of Philips, called and asked me questions like “How do you think Philips’ business is going to change in the digitization phase, or when we turn products into services?” He then told me that he considers digitization to be really important for the company . He mentioned that Philips had some IT-related issues that needed to resolve but he was seriously thinking about what IT would mean for the business in the medium-to-long term.

He asked me to work with Philips chief strategy officer to understand the ways to change our business to tap into the opportunities of digitization. I remember telling the leaders to embark on some of these journeys together. We put ourselves in the shoes of a pregnant woman who goes to the hospital to find out whether there are some complications in her pregnancy. How does she deal with it? How does she communicate with her caregivers? What happens during delivery, how does she care for the baby after delivery and while raising the child?

Now these are critical life events—pregnancy, your first child, your second child and so on. These are really intense emotional events. Many of us have experienced this and looked at the connection between the mother and the professional care providers – tools, services and information the mother may want to better understand her situation and take control of it.

Consider a few more use cases. What if your husband is diagnosed with heart failure? How does it change your life and how do you deal with it? What if your father passes away and your mother wants to still live in her home, but she has multiple chronic diseases and is at a high risk of falling? I have a good friend who lives abroad, he calls his mother who lives in Bombay every day. He is really worried about her, so he calls for two reasons: one to know if she is answering the call which means she is fine, and the other reason is to make sure she is taking her medication. The question becomes, how can one support an elderly parent with multiple chronic deseases at home?

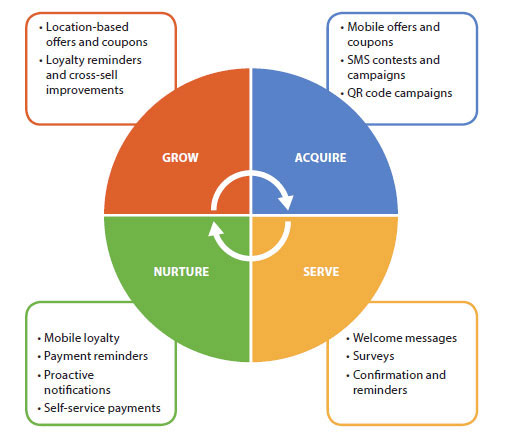

Now these are very important use cases. When you start looking deeper you realize that it is important for healthcare organizations to really connect with their customers: patients. For me, the definition of digital is very simple – it is continuous engagement. How can you continuously engage, learn and get better in supporting people.

Everybody can relate to this through their own health journey. There are huge gaps that exist today when it comes to professional care. Healthcare is organized around acute events like going to a doctor when you are feeling unwell. The doctor sees you, and possibly refers you to a specialist, who may prescribe medication or a course of treatment. Often there are weeks or months in between these visits.

In healthcare, real-time systems are needed, especially when situations are dire. For example, if I collapse with a stroke nobody knows who I am, my health background, the allergies I have, what medications I am taking or what my medical history is. Yet, I can go to India, stick my card in an ATM, even in Kashmir as I recently experienced, and get money because I’ll be identified and my transaction will be approved in real-time. My bank knows whether they should allow me to take out money or not. This demonstrates the tremendous need for digital in healthcare – to deal with day-to-day management of chronic disease as well as acute events.

One of the challenges our customers face is getting top executives’ approval of their ideas. The challenge here is that even though their teams have a pretty clear idea of what they want to achieve and how they will go about it, they do not know enough about the end-game. What would be your advice to them? How should they package their strategy for the executive team?

There are a couple of ways to approach this. First, you have to understand where you’re going. You need to have a clear vision and a passion for that vision, because passion supplies the energy you need. The second condition is that you have to introduce the concept of a dynamic business case – a business case with a fully iterative approach. The art is to have clear gauges along the way. Say I have this great idea. I have a sense of how I am going to do it, but I don’t know exactly which road I am going to take. Without an obvious need you can’t make a great proposition. Just connecting an existing product won’t do the trick. It should be the other way round. Identify a clear need, create a clear proposition around it and then look at how to enable the continuous engagement.

In a digital world, you connect early in the product development process and co-create with customers. We set up the

HealthSuite Labs to do just this. We still have a traditional visitor center, but it’s my prediction that the visitors center is going to gradually disappear. Our customers want to co-create. The cool thing about co-creation labs is that you collaborate on a joint vision. We have done spectacular stuff in this area. We have actually had the CEO of a large hospital, two home care organizations, five physicians and five patients participate in a lab and we were all creating the patient journey, something which none of them there had ever done.

Most systems in the world are designed for one to three perspectives. Very few systems are designed for 10 different perspectives. So, I think that is the art when you bring people together and you go through the design together. You let them feel ownership and then you empower them to jointly improve on that. So that’s the iteration.

And yes, I think a lot of executive team members have to change their way of thinking. If you come from a product world, especially medical products, you have to laboriously specify everything to the tiniest detail. There will be hordes of people who want to say no; everybody wants to protect the downside. But, so there is no upside if you don’t push the boundaries, take some risks. This is when you have to introduce entrepreneurial thinking and say of course we understand there are constraints and potential issues that we have to live with, but that doesn’t mean it should take five to 10 years to develop a product. You have to get early feedback and let the feedback drive the way you develop. Now that’s a different mindset.

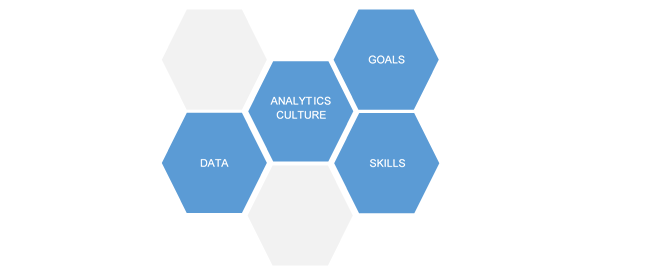

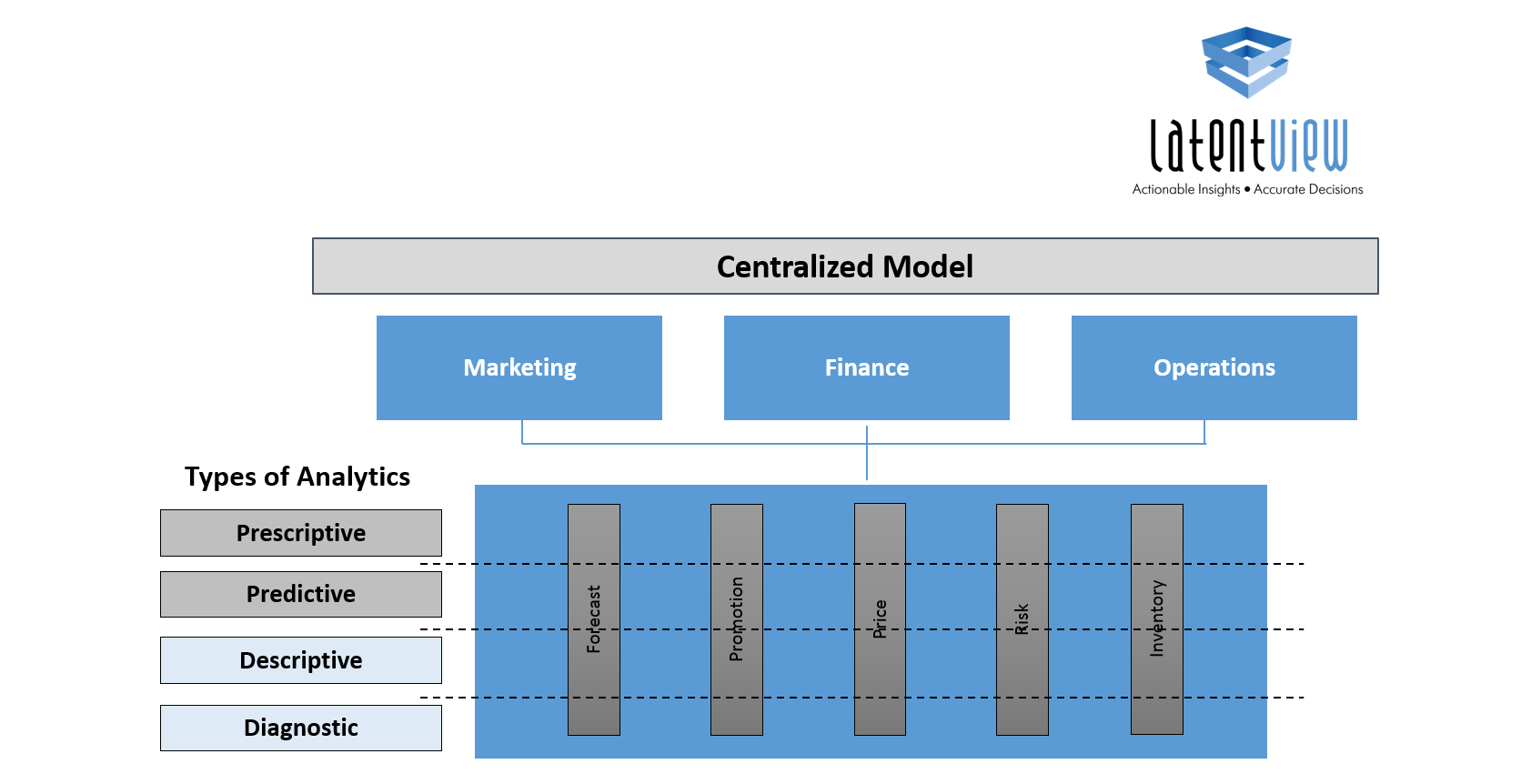

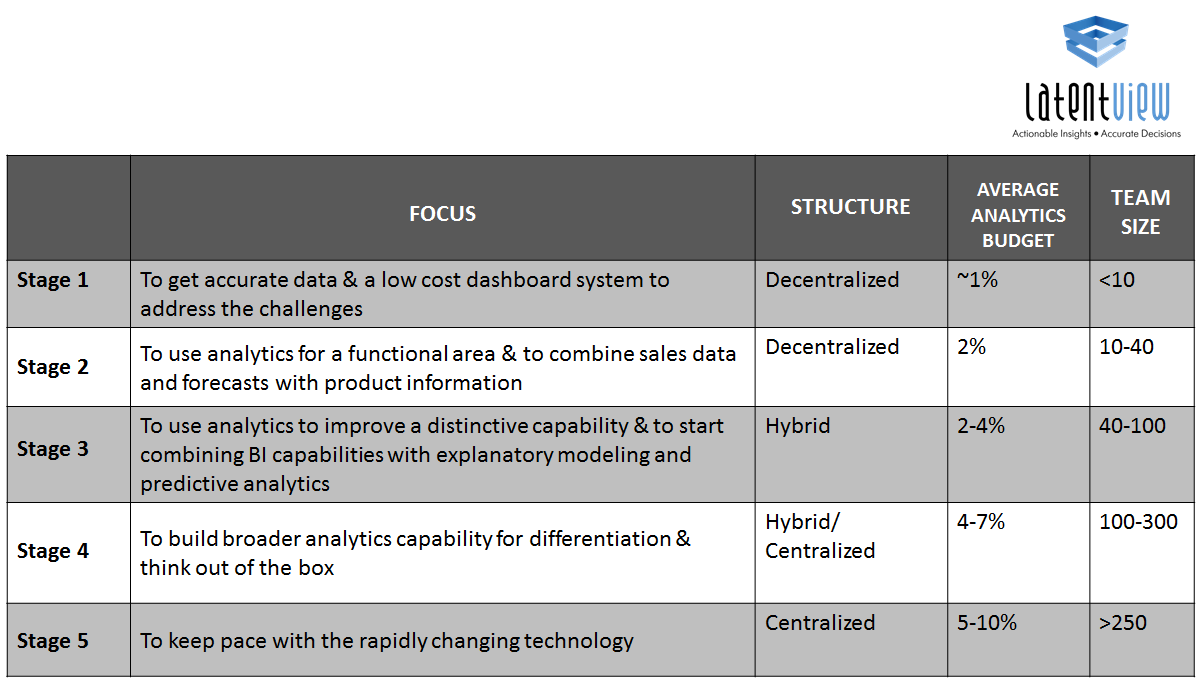

In large organizations with tens of thousands of employees, there is this small analytics team with 20- or 25- people recruited from companies like Amazon and Google. They are considered the cool guys. After a while, these cool guys start complaining about the ‘old’ part of the organization. The organization complains that they don’t know what these guys do, they look like my children but they are making more money than me. So my question is, while introducing analytics into a large organization, where should it reside – centrally, with the businesses, or is there a roadmap?

Ultimately, it’s got to be in the business. For example, Egbert van Acht, CEO Business Group Health & Wellness at Philips Consumer Lifestyle, knows his business really well. He starts looking at what data and connected propositions can do for his business. He jumps on the bandwagon and his team starts creating some really cool propositions with toothbrushes, pregnancy monitors, etc. So, the cool guys are only going to be successful if we have leaders like Egbert who say I want to experiment with this. I want to learn quickly. I know I am not going to get it right the first time, but I’m going to get it right eventually. I will hire people on my team who understand and love this idea and that’s the way we are going to do it. If it’s not really embedded in the business, it’s not going to succeed. You can have the coolest small team in the world, but they are not going to change the company.

It’s great that you have mentioned real time connectivity and a connected world. It’s important and certainly possible in the western world where data is consistent and surmountable. What is your take on the developing world where the population is large and data is disparate? How do you see it connecting?

I have talked about pregnancy. Both in India and Indonesia there are very high instances of maternal mortality and typically these are a result of simple causes. We have started looking at how we can address this problem at scale because there are just not enough specialists in countries like Indonesia, for instance. For example, in a population of 250 million people spread over 15,000 islands, there are only a couple of thousand obstetricians.

The fortunate thing is that they have very good mobile coverage. So clearly the answer to your question is mobile technology. We need to allow midwives, to visit pregnant women and start measuring basic vital signs. They can use a simple doppler to get a sense of how the fetus is developing and growing. This device is connected to a mobile phone via an app. We created a backpack for the midwives with the tools to diagnose pregnant women. The data is collected and uploaded to the cloud. This data is analyzed using algorithms. The system helps in identifying the cases that are critical and require attention of a obstetrician.

Therefore, you can dramatically improve coverage and you can apply this model. As a result, an doctor sitting in Jakarta can now handle 300 patients a day instead of handling 30 patients a day. The model is very straightforward. You give people simple tools and analyze the data. Sometimes simple tools go a long way.

There has been virtually no enterprise automation in healthcare. It has always involved people and more people. Now is the time we can break this cycle and start using simple devices, data and, of course, mobile technology. We aggregate and interpret the data to allow decision making so that the specialists – a cardiologist or a dermatologist – can do this at very high volumes and increase their capacity not only by 20 percent or 30 percent, but by more than 500 percent.

These models are starting to work around the world. We are now working with leaders like Dr. Shetty in Bangalore on what we call “massively scalable healthcare”. Of course, he is a visionary and the world’s best cardio surgeon. His hospital has 7,000 beds and they have created a whole medical city around it. It’s amazing that he is doing cardio surgery for $1,500, while in the United States, you would pay a hefty $100,000. That’s kind of efficiency we can create if we are lean and work at scale with automation.

What type of business models do you want to put in place where a company like a Philips is looking at moving from a product to service or platform? How do you see that as a future?

Moving from offering products to services can be very beneficial for a company. I can sell you an MR machine for $2 million. I conduct that transaction and move on to sell another MR machine to another customer. Now, what happens if I sell it to you as a service? I’ll get that continuous engagement with you because I’m not going to just help you to optimize how the machine is going to work, but I’m also going to take it one step further and look at how I can optimize the asset and the environment in which you use the asset. And, it doesn’t end there. The more I know about the patient I can automatically configure the device. I can help you with the workflow. I can see where there is a bottleneck and over time improve the technology. I can help create better outcomes for patients.

We are doing it with patient monitoring as well. We have 53 percent of all patient monitors in the U.S. and everybody asks me if am afraid of commoditization. My answer to commoditization is monetizing as a service. What am I going to offer? Of course I’m going to offer the best high fidelity monitoring, but I’m also going to provide clinical context on monitoring in-patients – something that no company knows as much about as us.

We have a profile of patients that we mash up with real-time data and, as a result, we have started seeing things. We can now predict 24 hours in advance if somebody is going to get a cardiac arrest and that means I have a 24-hour window to intervene and avoid an acute event. We can see early symptoms of potential infection and can optimize length of stay of patients in the hospital. We know exactly when to discharge a person without a risk of that person coming back for the same ailment, which can be costly if, like in the US, readmissions within 30 days after discharge are not being reimbursed.

We just created this proposition for wearables, so if you discharge somebody from the hospital you can still take to monitor the patient from home. We are now giving caretakers a continuous engagement with their patients. Instead of being a B2B provider of products which we are today, we are transitioning to become a service provider and, ultimately, we are going to help our customers continuously engage with their customers (patients).

Yes, it will have an impact on our short-term revenue, but it will have a huge positive impact on our future revenue. We are already running health informatics as a service. Now we have to focus on growing from the base and establish the more predictable stream of recurring revenues.

I can see real big benefits coming for Philips from this transition in the long run. What is your single biggest issue in adapting this business model?

While designing a product you go through endless cycles to get it perfect and then launch. You will then find out what customers think of it. Then there is another six months to a year before you can do the next release. Everything is organized around the product. Now we are talking about services. The bulk of our revenue is still products. That’s also where the gravity is. Somehow we have to start breaking that gravity and that’s hard. You have to find the right partners in the organization. It’s not just one person who is pushing and pulling. There are a couple of business leaders starting to drive in this direction. Philips has a CEO who is saying this is the direction we are taking and then you start seeing gradual change. We need to create momentum and that momentum will change the gravity.

How is the competitive landscape in the healthcare equipment domain and how do you ensure that you are creating value?

Competition is really interesting in this sector because it radically changes year after year. Last year IBM decided to invade our space as they bought Merge, Phytel and Truven. So we had to reevaluate how we deal with IBM because they are also a big supplier to us.

This week, Siemens and IBM decided to start working together, which is interesting because Siemens just established the Joint Venture with Cerner, a big healthcare IT company. Google is big time into this space. Everybody knows that Apple too decided to get into health. Having all the big guys enter our space is changing what we are doing. I heard someone talk about ecosystem. What we have decided is to create our own ecosystem, so we are hooking up with Amazon. We are competing with Qualcomm, but we decided together we are going to create the Internet of Medical Things. This is different from managing a supplier or distributor. Ecosystems that include customers and competitors are the future of digital business.